Hold onto your avocado toast because the notorious Wall Street mega-landlord Blackstone has set its sights on the Golden State's housing market. And they're not here to make friends or keep rents affordable. They're here to make cold, hard cash on the backs of hardworking Californians, one outrageously priced rental unit at a time.

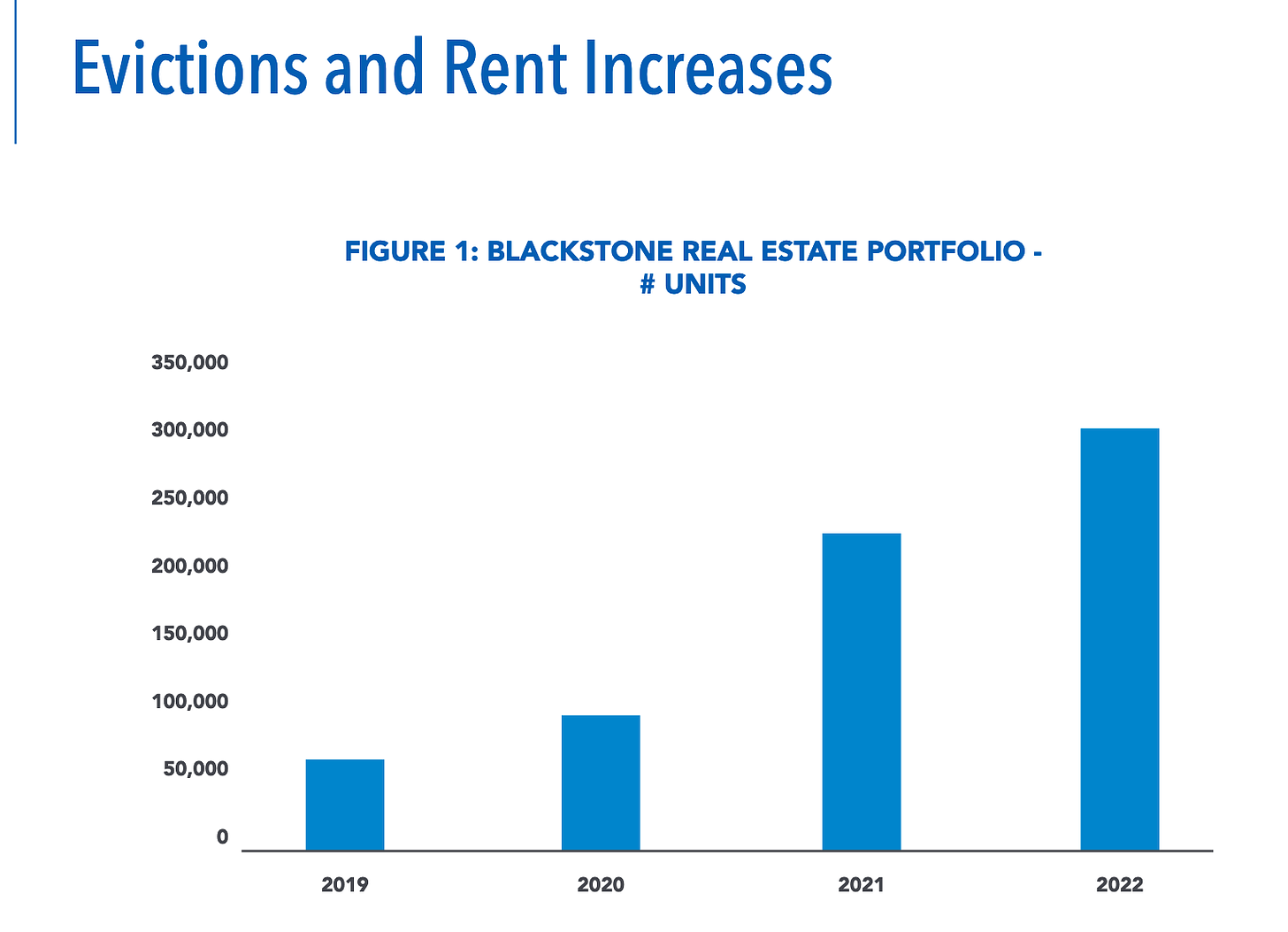

Blackstone, led by billionaire CEO Stephen Schwarzman (who raked in a cool $1.2 billion in 2023 alone), has been on a recent buying spree, snapping up a staggering 8,300 apartments across California with its recent $10 billion acquisition of AIR Communities.

That's right, $10 billion.

I guess when you're the world's largest private equity firm with $975 billion in assets under management, dropping a few billion on some California real estate is just another day at the office.

Blackstone already owns a whopping 28,000 single-family rental homes nationwide. And with its pending $3.5 billion purchase of Tricon Residential and its 38,000 homes, Blackstone is poised to become the third-largest owner of single-family rentals in the U.S., behind only American Homes 4 Rent and Invitation Homes. It's like a real-life game of Monopoly, except instead of little plastic houses, they're buying up actual homes where real people live.

You might be thinking, "But wait, don't we need more rental housing in California? Isn't this a good thing?"

No.

Blackstone and its ilk aren't in the business of providing affordable housing out of the goodness of their hearts. No, they're in it to maximize profits for their shareholders and conduct the bidding of WEF founder Klaus Schwab: 'You will own nothing and be happy.'

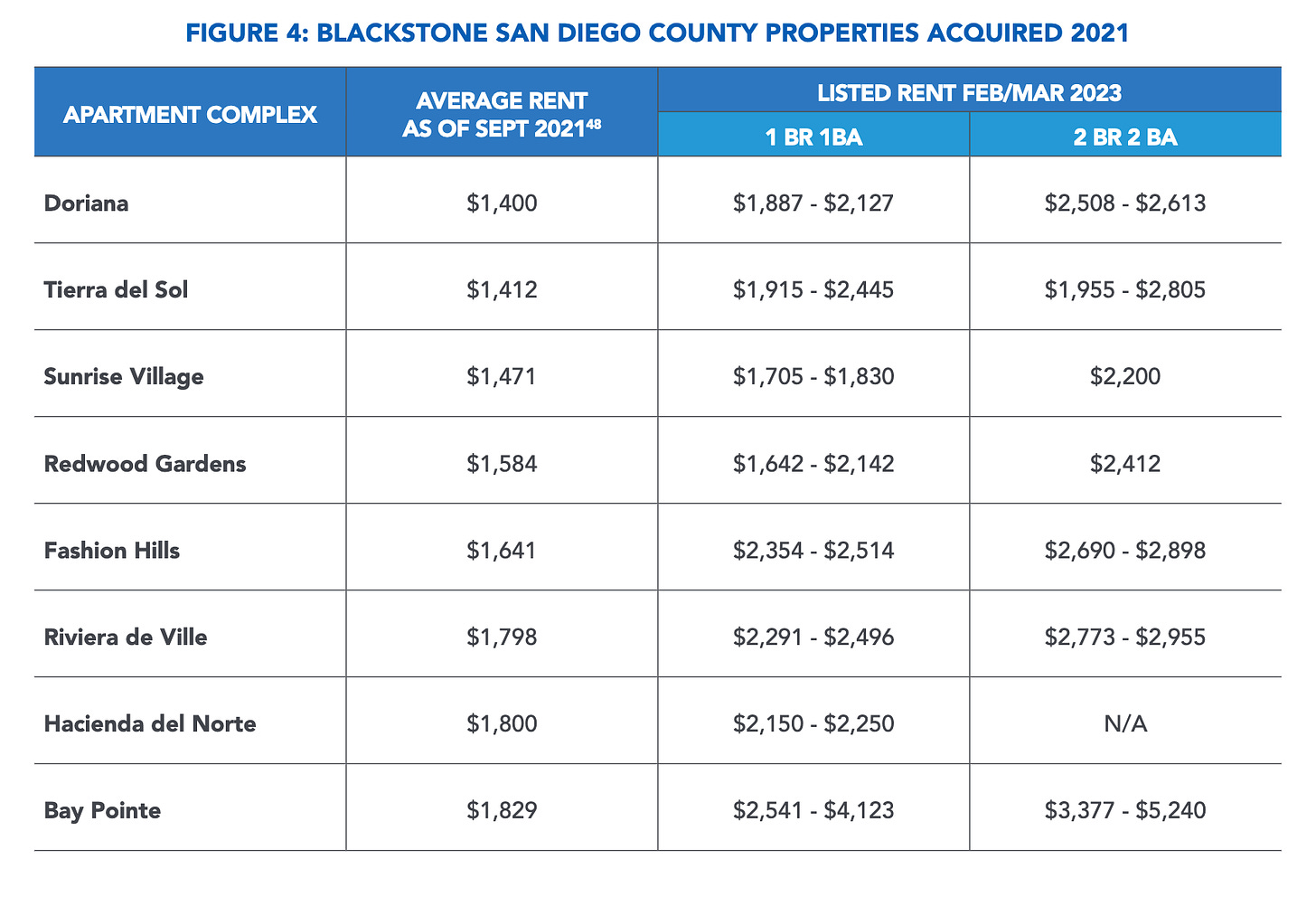

Take San Diego, for example. In 2021, Blackstone swooped in and bought up 5,600 affordable housing units. And what did they do? They promptly jacked up rents by a jaw-dropping 43-64% in just two years. I'm sorry, but in what universe is a 64% rent hike in 24 months justifiable?

Oh, right, in the universe where Wall Street greed reigns supreme.

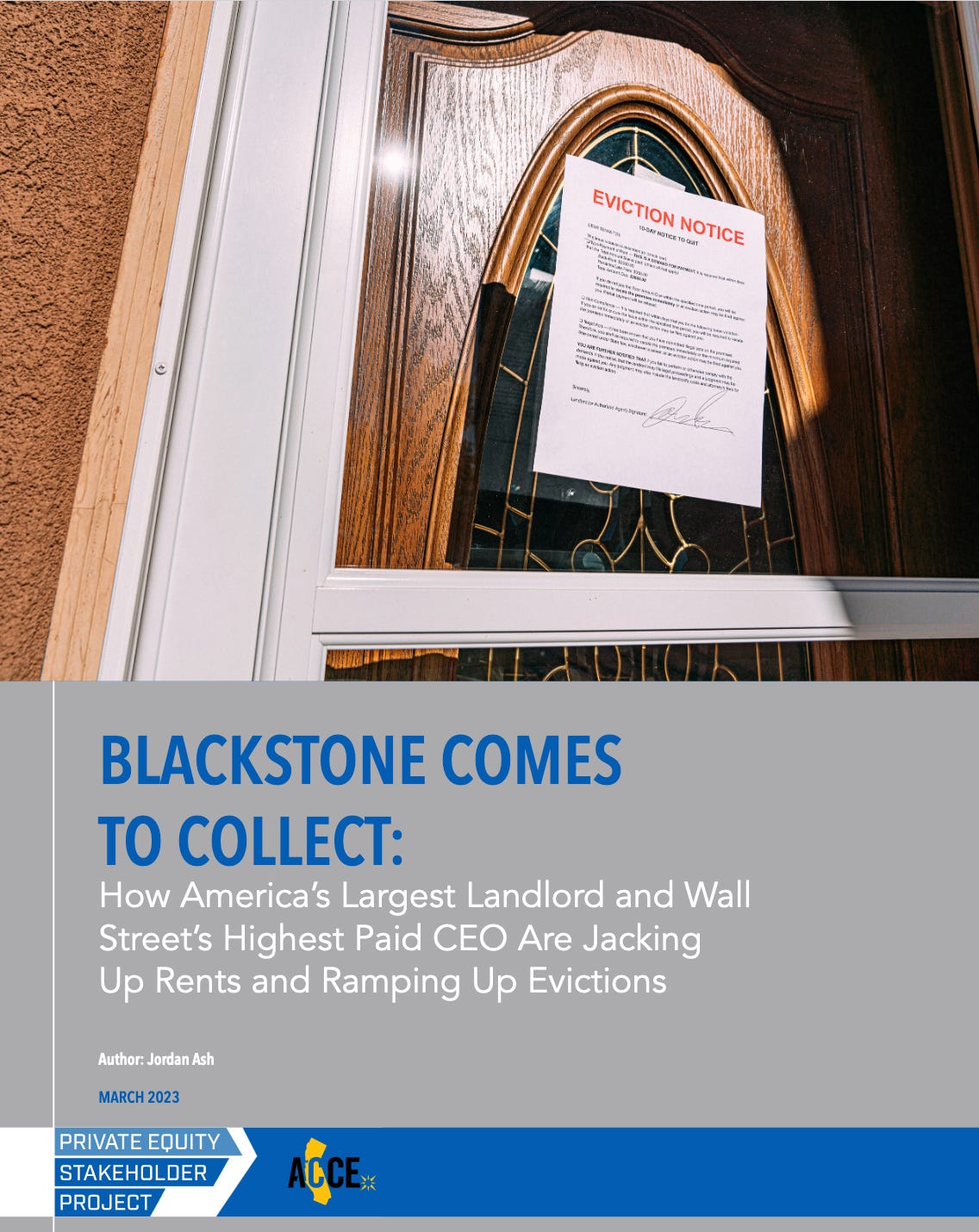

But it gets worse. Since Blackstone lifted its voluntary pandemic eviction moratorium, it's been evicting tenants left and right. In Georgia, the company filed 170 evictions in a single month. In Arizona, it filed 70 evictions in September alone. And get this: in some cases, Blackstone moved to evict tenants who were just one month behind on rent. One month! Whatever happened to compassion? Oh, I forgot, compassion doesn't pay dividends.

And let's not forget about the squalid living conditions some Blackstone tenants have had to endure. Cockroach infestations, shoddy repairs, lack of heat in the dead of winter. Is this what passes for "luxury living" in Blackstone's world? I guess when you're too busy counting your billions, little things like basic human dignity fall by the wayside.

But surely our esteemed leaders in California are doing something to rein in these corporate predators, right? Right? Wrong! In a twist that would make even the most cynical among us do a spit-take, the University of California, that bastion of progressive values, decided to pour $4.5 billion into Blackstone's real estate investment trust. Yes, you read that right. The same UC system that only houses 38% of its students and where many workers struggle to make ends meet thought it would be a grand idea to cozy up to Blackstone.

Let's not forget about Blackstone's cozy relationship with USC. The private equity giant owns American Campus Communities, which runs some of USC's student housing. So not only is Blackstone jacking up rents on families and seniors, but it's also profiting off the backs of broke college students.

CALPERS ON THE DEFENSE

But wait, it gets even more outrageous. Guess who's been funneling billions of dollars into Blackstone's coffers? None other than the California Public Employees' Retirement System (CalPERS), the largest public pension fund in the United States. That's right, the very same pension fund that's supposed to be looking out for the financial well-being of California's public employees has been cozying up to Blackstone to the tune of $7.8 billion.

In a twisted irony, CalPERS is investing in the very company that's been jacking up rents and evicting tenants across the state. Blackstone tenants, labor unions, and community groups have been calling on CalPERS to divest from Blackstone, citing the private equity giant's "predatory rental practices" and "exploitation of California's housing crisis." But so far, their pleas have fallen on deaf ears.

It's a sickening cycle: Blackstone buys up apartments, hikes up rents, and evicts tenants, all while raking in billions from public pension funds like CalPERS. Meanwhile, the very public employees whose pensions are invested in Blackstone struggle to keep a roof over their heads.

WHEN DO WE EVICT BLACKSTONE?

There are some glimmers of hope amidst this sea of greed and despair. Tenants are fighting back, forming unions, and protesting Blackstone's predatory practices from San Diego to Los Angeles. Even some politicians are starting to take notice, with Representative Katie Porter calling out Blackstone's "exploitation" of the housing crisis.

But let's be real. It's going to take a lot more than a few protests and strongly worded letters to stop the Blackstone juggernaut. We need real, systemic change. We need to close the loopholes that allow corporate landlords to evict tenants on a whim and jack up rents with impunity. We need to invest in truly affordable housing, not just line the pockets of billionaire investors. And we need to hold our leaders accountable when they cozy up to Wall Street at the expense of their constituents.

Because, at the end of the day, housing is a basic human right, not just another commodity to be bought and sold for profit. It's time we started treating it as such.

So the next time you're writing that rent check to your friendly neighborhood corporate landlord, just remember: every dollar you send their way is another dollar they can use to buy up more homes, evict more families, and make life just a little bit harder for the rest of us.

But hey, at least Stephen Schwarzman can afford another ivory back scratcher or whatever it is billionaires spend their money on these days. Silver linings, right?

Until next time, my fellow tenants and aspiring homeowners. Keep fighting the good fight. And maybe, just maybe, we can take back our homes and our communities from the clutches of Wall Street before it's too late.

If you find these interviews and articles informative, please become a paid subscriber for under 17¢ a day. I don’t believe in paywalls, but this is how I make a living, so any support is appreciated. Either way…. it’s available to you….

Share this post